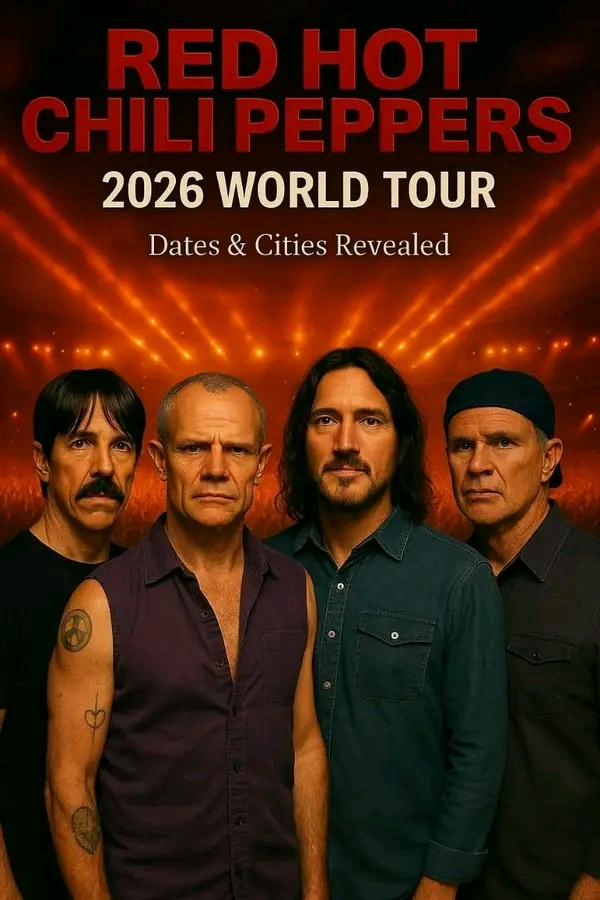

Warner Music and Bain in Talks for $300 Million Deal on Red Hot Chili Peppers Catalogue.

July 1, 2025

Warner Music Group (WMG) and private equity firm Bain Capital are reportedly in serious discussions to acquire the recorded‐music catalogue of the Red Hot Chili Peppers in a deal valued at over US$300 million. The move would mark one of the most prominent catalogue purchases in recent years and comes as part of a newly launched joint venture between Warner and Bain aimed at acquiring music rights on a large scale.

What’s under negotiation

- The reported deal targets the recorded masters catalogue of the Red Hot Chili Peppers, including hits such as Californication, Under the Bridge, Dani California, Otherside, Snow (Hey Oh), Can’t Stop, and Give It Away.

- It is not yet confirmed whether all recordings (including early albums released under EMI) are included. Some of the albums were released via Warner, others via EMI; ownership and inclusion of all segments are part of what’s being negotiated.

- The band is said to be seeking a price upward of US$350 million for what is potentially the full catalogue of their recorded masters. However, sources suggest that a deal in excess of US$300 million may be closer to what Warner + Bain are willing to offer.

The bigger context: Warner-Bain joint venture

- Warner Music and Bain Capital recently announced a venture to invest up to US$1.2 billion in acquiring music catalogs. This reflects a strong strategy to buy in to high-quality, enduring song assets rather than being passive partners in streaming.

- Under this joint venture, Warner would bring its operational expertise—marketing, distribution, catalogue administration—while Bain supplies financial muscle. Each partner is reportedly providing equal equity in the venture.

- The Red Hot Chili Peppers catalogue is being viewed as a potential marquee asset for this venture—if the deal goes through, it would be a high profile acquisition in what is becoming a very active market for legacy music rights.

Why this deal (and others like it) are happening

Several interlocking market trends help explain why Warner + Bain are making this move:

- Music as an investment asset class. Streaming revenues, sync licensing, use in film/TV/advertising, and global streaming growth have revived interest in owning song and master rights. Even amid general economic uncertainty, music catalogues have shown resiliency.

- Valuations of catalogues remain high. Though multiples (price paid relative to annual net royalties) have softened somewhat from peaks around 2022, iconic catalogues still command premium prices.

- Strategic synergies. For Warner, owning more catalogues strengthens its business beyond new releases: revenues from masters, reissues, sync, merchandising, possibly even image / licensing rights. For Bain, this is a financial bet on long-term steady cash flows.

- Precedent and competition. Other major portfolio and fund investors (including Blackstone, Apollo, etc.) have been acquiring sizable catalogue assets. Deals like those for David Bowie’s catalogue (~US$250 million) and David Guetta’s (~US$100 million) are part of this landscape.

Financials and valuation

- The Red Hot Chili Peppers’ catalog is estimated to generate around US$26 million in annual revenue. After expenses like production, distribution, and warehousing, the net label share (NLS) is estimated somewhere between US$15–20 million.

- Based on those figures, if a buyer (like Warner + Bain) were to pay ~US$325–350 million, that implies multiples in the ballpark of 17× to 23× NLS, depending on assumptions. These multiples are on the high side, though not unprecedented for iconic catalogues.

What may block or complicate the deal

Although everything appears promising, there are risks and open questions:

- Deal may not go through. Sources cautioned that while talks are ongoing, there is no guarantee of a signed agreement. Negotiations over what exactly is included (which masters, portions of EMI records, rights beyond masters) can complicate value and price.

- Valuation risk. Paying high multiples could backfire if royalty streams decline, streaming trends shift, or licensing opportunities wane. Also, interest rates (which affect discount rates) matter: higher rates make future cash flows less valuable.

- Revenue vs profit. The quoted US$26 million annual revenue doesn’t equate to profit. Costs of maintaining, marketing, distributing, and administrating masters can eat into returns.

- Ownership and inclusion ambiguity. Some of Red Hot Chili Peppers’ earlier albums were released under EMI, and it’s not clear if those are fully controlled by the band or included in the sale. Also, rights such as merchandising, image/name/licensing might be separate.

- Market momentum and competition. Other catalogue buyers are circling iconic assets. To win, Warner + Bain may need to offer a strong price, terms, or strategic benefits. That intensifies competition, potentially pushing price higher.

Implications for the band, the industry

- For Red Hot Chili Peppers, the sale of their recorded masters could provide a large lump-sum payout, potentially tens or hundreds of millions of dollars ahead of future earnings. Having already sold their publishing for ~$140-150 million to Hipgnosis a few years ago, this would represent a further monetization of their legacy.

- For Warner + Bain, owning such a catalogue would enhance their prestige and revenue base. It strengthens their position in ongoing debates around rights ownership, streaming economics, and artist compensation. It may also help Warner better compete with Universal Music, Sony, and nontraditional investors who are increasingly active in catalog assets.

- For the music industry more widely, this deal underscores how legacy music catalogues have become prime assets. As revenue from streaming continues to grow, and as older music finds new life in sync, film/TV, commercials, social media, rights owners are increasingly treating catalogs like real estate or infrastructure: durable, income-generating, and valuable.

- There’s also a cultural dimension: when rights change hands, questions arise over how the music will be managed—remasters, reissues, legacy care, licensing for adverts/commercials, image use, etc. Fans and artists sometimes worry about creative control and how the catalogue will be treated.

What to watch next

- Whether Warner + Bain confirm or deny the deal; how terms are settled—what exactly is in the catalogue (recorded masters, masters from all eras, territories, etc.).

- Whether Red Hot Chili Peppers accept the offer or seek higher bids; whether other suitors emerge.

- How the valuation multiples compare with other recent large catalog deals, especially as interest rates and valuations in the broader market fluctuate.

- The strategic action Warner + Bain take with the catalogue once acquired: reissues, deluxe editions, licensing, use in film/TV, leveraging global streaming growth, etc.

- Any regulatory, rights management, or legal issues especially with EMI records or older contracts, which might complicate or delay completion.

Conclusion

The reported Warner Music + Bain Capital deal to acquire Red Hot Chili Peppers’ recorded catalogue for over US$300 million is emblematic of a larger trend: major industry players and financial investors betting heavily on the long-tail value of iconic music. For WMG and Bain, landing this deal would not only bring a guaranteed revenue stream but also help position them as a go-to buyer for high-value catalogues. For RHCP, it could be a way of capitalizing on decades of hits in one transaction.

But whether the deal gets done will depend heavily on negotiations over the scope of what’s being sold, valuation charts, competing interest, and how much the buyer believes the catalogue’s future cash flows justify a hefty price tag.